Europe's grandfather economy in one graphic

Whether through mergers and acquisitions, reinvention, or long-lasting family dynasties, the Old Continent continues to cling to firms that have lived longer lives than most European countries.

One stark difference in the European economy, as compared to most other regions, is the domination by firms that have spanned for generations.

Whether through mergers and acquisitions, reinvention, or long-lasting family dynasties, the Old Continent continues to cling to firms that have lived longer lives than most European countries.

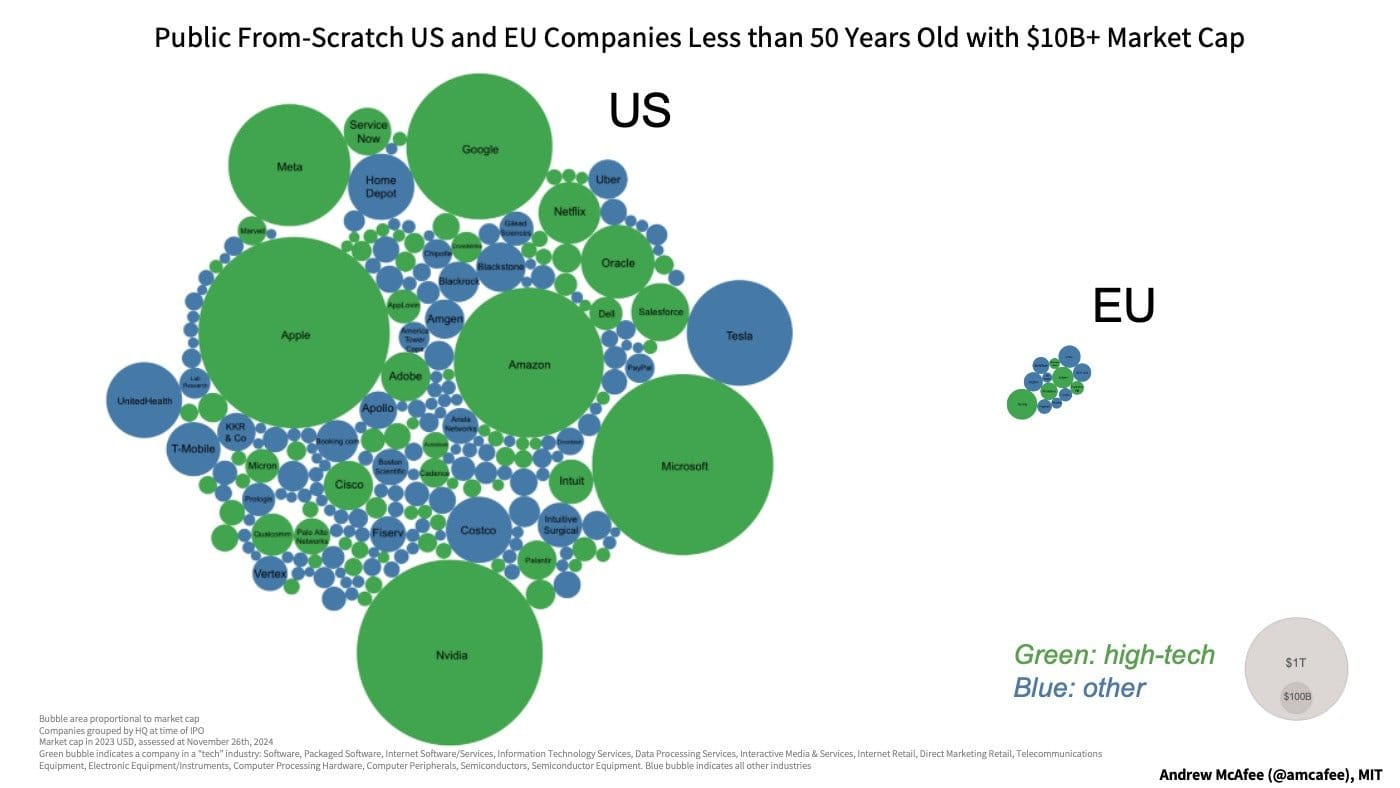

This fact was presented rather sly, by omission, in a graphic making waves in the circle of Transatlantic public policy by an American research scientist at MIT, Andrew McAfee.

In a post on his Substack, McAfee hones in on a specific line from the Draghi Report on European competitiveness about the age of various European champions:

"There is no EU company with a market capitalisation over EUR 100 billion that has been set up from scratch in the last fifty years, while all six US companies with a valuation above EUR 1 trillion have been created in this period"

Using his own calculations, McAfee presents the juxtaposition between firms with a market capitalisation over $10 billion that are younger than 50 years old in the US versus the European Union, as well as whether they are tech firms or something else.

The difference could not be more clear:

This, in a nutshell, demonstrates Europe's grandfather economy.

Newly founded EU tech companies like Spotify, Adyen, Amadeus, and Delivery Hero pull their weight, but they are dwarfed by American tech firms. This isn't surprising by any means.

The largest European companies by market capitalisation all have old origins.

Novo Nordisk, the continent's shining star at the moment, was founded in its original form, before mergers, in 1923. The fashion and luxury brand LVMH can be traced back to Moët & Chandon and Hennessy back in the 1700s, while Hermès was founded just a century later.

Technically, the two youngest European firms in the top 5 European companies by marketcap are the German software company SAP (founded in 1972) and the Dutch chipmaker ASML, though its origins can be traced back to a 1984 joint venture between ASM, founded in 1969, and the iconic electronics brand Philips, founded back in 1891.

By McAfee's telling, this graphic is "not a pretty picture for Europe," and provides evidence for his claim that "the EU is putting too many restrictions and requirements on its young tech companies".

While various posts here on EU Tech Loop could easily echo McAfee's argument, the truth is that the model of European vs. American innovation is fraught for comparison.

The deep pockets of the American capital markets provide a much different investing climate that inevitably favor upstarts, as well as the unified language and culture that make scale much more realistic and possible.

But at the same time, European innovators have long-held experience with growing and sustaining companies over many decades and paradigm shifts. The continent is flush with company savings, which are currently parked abroad in more exciting markets.

Can they adequately accommodate tech upstarts? Can European legislators also implement the legal reforms demanded by Draghi if the EU wants to catch up?

These are larger questions that entrepreneurs will have to contend with just as much as regulators will aim to solve for. The push for a Capital Markets Union will be a necessary ingredient, but so will the full recommendations of the Draghi report and beyond - including a stronger push for Single Market, harmonization of rules across the EU and, overall, better access to finance.

Will the EU be youthful enough to deliver?