EU and global AI race: an evaluation

The race for dominance in Artificial Intelligence (AI) is heating up, with the European Union (EU) struggling to keep pace with the US and China.

While the adoption of the EU's AI Act has brought many discussions about the future of AI in the EU, with policymakers putting a lot of emphasis on the EU's regulatory influence across the world, various global rankings show much room for improvement for the EU as a whole, as well as separate countries.

A crucial first point to consider is that the EU is not a monolithic entity. While the EU strives for a single market, vast differences exist between member states, especially between the East and the West.

Although tempting for PR and policy-making purposes, comparing the entire EU to the US or China is misleading and hindering progress. Instead, we must look at individual countries' performance for a more nuanced picture and recognize and address disparities within the EU.

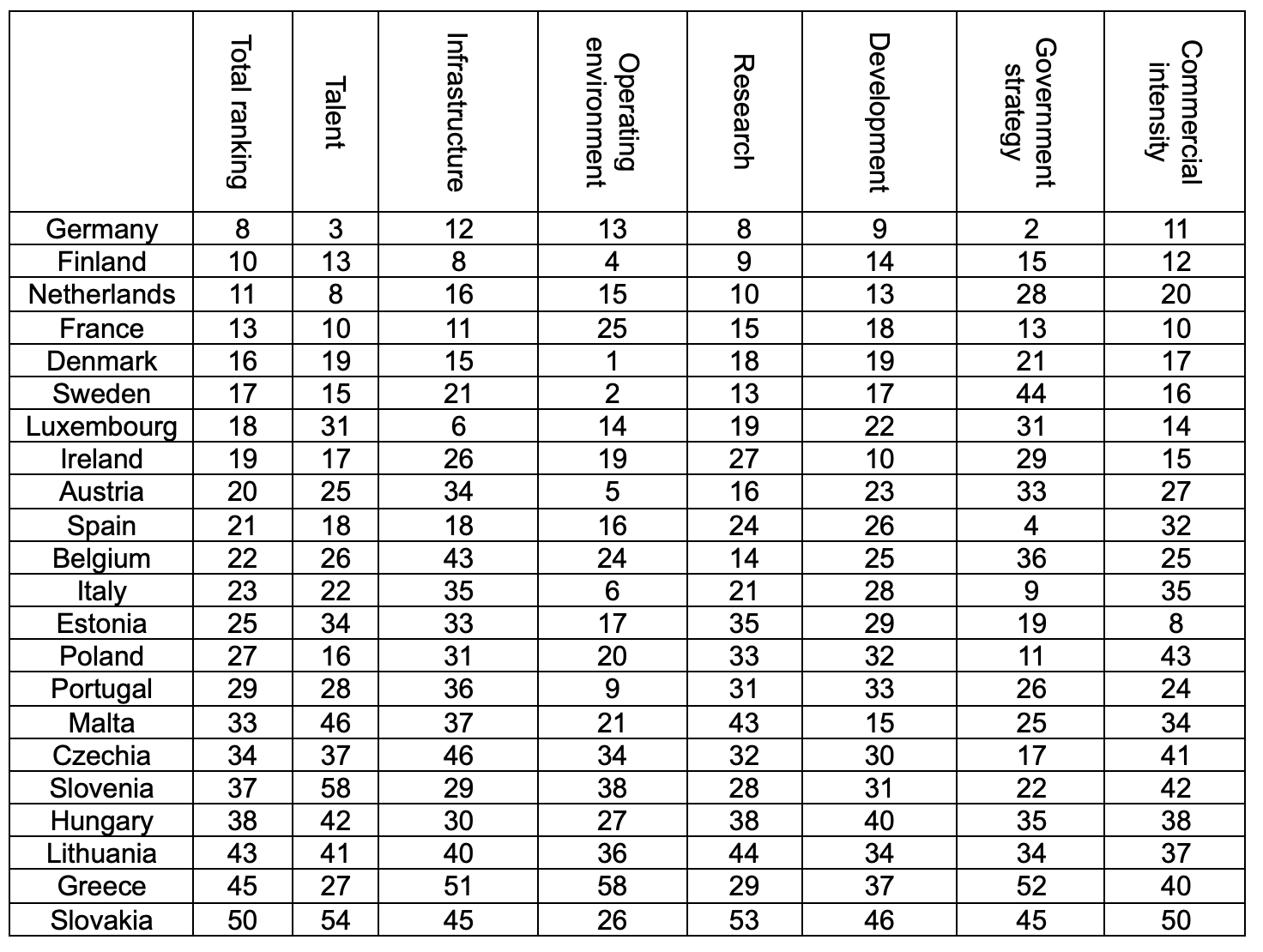

EU's AI leaders and laggards: Global AI index 2023

In Tortoise Media's Global AI Index 2023, Germany is ranked No. 8, ranking behind the US, China, Singapore, the UK, Canada, South Korea, and Israel.

Germany's strengths are its talent—No. 3 globally—and government strategy—No. 2 globally. However, Germany scores lowest in operating environment, infrastructure, and commercial intensity.

Finland is the following country ranked after Germany at No. 10 globally. The Finns excel in operating environment - No. 4 and infrastructure - No. 8 in the world. Finland scores lowest in research (15th place) and development (14th place).

The Netherlands follows Finland at No. 11. The Dutch rank best in talent (No. 8) and research (No. 10) worldwide. However, they score lowest in government strategy (28th) and commercial intensity (20th).

France ranks No. 13, with talent (No. 10) and commercial intensity (No. 10) being the best. France scores lowest in operating environment (25th) and development (18th place).

Denmark ranks No. 16 - with a top ranking of No. 1 in operating environment globally. Denmark scores lowest in government strategy (21st) and development (19th place).

Sweden is No. 17. Similarly to Denmark, the operating environment is their main strength (No. 2 globally). Sweden's lowest score is in government strategy (44th).

Luxembourg is No. 18 and is best at infrastructure (No. 6 globally). However, its lowest scores are in government strategy (44th) and talent (21st).

Ireland is No. 19. The Irish look the best in development, as a global tech hub should. Their lowest scores are in government strategy (29th) and research (27th).

Austria is No. 20, and it is best ranked for operating environment (No. 5 globally). Austria scores lowest in infrastructure (34th) and commercial intensity (33rd).

Spain is No. 21, ranking best in government strategy (No. 4). Spain's lowest score is in commercial intensity (32nd place).

Belgium is 22nd, scoring lowest in infrastructure (43rd) and government strategy (36th).

Italy is No. 23. Similar to Scandinavian countries, Italy looks best in the operating environment (No. 6) and government strategy (No. 9), with its lowest scores in commercial intensity and infrastructure (35th).

Estonia ranks the highest among the EU11, taking 25th place - with commercial intensity at 8th place globally being their best score - as a startup nation should. Estonia ranks lowest in research (35th), infrastructure (33rd), and talent (34th place).

Poland is 26th, with its best score in government strategy (No. 11), while its commercial intensity has its lowest score at 43rd place.

Portugal is 29th, with operating environment being their best score—No. 9—and talent (No. 38) and infrastructure (No. 36) being their lowest scores.

Malta is 33rd, Czech Republic 34th, Slovenia 37th, Hungary 38th, Lithuania 43rd, Greece 45th, Slovakia 50th.

Romania, Cyprus, Bulgaria, Latvia, and Croatia are not listed in the ranking.

Stanford AI index 2024

Another index to consider is Stanford's AI Index of 2024.

In this index, France is notably ranked 3rd worldwide for the number of significant machine learning models, with 8 models. It trails only the US, which has 61 models, and China, with 15 models. Germany follows closely behind France with 5 models.

Regarding talent, the EU is vital in producing new informatics, computer science, computer engineering, and IT graduates. Germany boasts 19,920 graduates, ranking second only to the UK. Poland follows with 9,241 graduates (ranked fourth), Italy is fifth with 8,508, the Netherlands sixth with 6,877 graduates, Romania seventh with 6,740, Spain eighth with 6,650, Portugal ninth with 3,696, Finland with 2,970, Czechia with 2,670, Ireland with 1,995, and Austria with 1,900 graduates. It is widely acknowledged that the EU is a hub for ICT talent; however, the question remains regarding how motivated this talent pool is to stay in the EU and work for European companies.

Key outtakes: disparity between East and the West, need for high-skilled talent and more commercial activity

While indexes are often criticized for presenting a fragmented picture, and AI ecosystems have developed rapidly over the past year, the results reveal a significant disparity between Eastern and Western EU.

There is a need for high-skilled talent, especially on the Eastern flank of the EU, where significant brain drain occurs outside of the country despite a high number of ICT graduates.

Enhancing development levels is also necessary. In the global AI race, commercial intensity—startup activity and private investments in AI—is particularly important. Only Estonia, Germany, and France rank in or around the top 10 globally.

Various factors encourage commercial activity, including favorable regulatory and tax environments and a risk-oriented culture. Achieving commercial activity in AI is especially challenging for smaller EU countries, such as those in Central and Eastern Europe. Due to smaller market sizes, startups are often globally (and US) oriented from the outset.

Lastly, innovation usually thrives in environments that foster an entrepreneurial spirit. While Europe performs adequately in research, it falls behind in development and innovation, requiring creativity and a risk-taking mentality. European science institutions traditionally prioritize research over development and commercialization.