Draghi report: innovation, telco, tech and to-do's for smaller EU Member States

The former head of the European Central Bank (ECB), Mario Draghi, presented his competitiveness report this week.

Draghi's report is best read after getting acquainted with Enrico Letta’s Single Market report, as well as Ursula von der Leyen’s political guidelines for 2025-2029, published earlier this year.

This article reflects on Draghi's proposals for the innovation promotion & digital technology sectors.

Cold welcome in the North, overfocus on the US

800bn & NATO. Proposals to increase investments up to 800 billion euros per year have already received a chilly reception from the more fiscally conservative northern EU countries and the liberal faction of the German government. This reaction is not only due to the scale of the proposed investments but also because of discussions about enhancing European defense capabilities, which is sometimes seen as an ideological shift away from NATO.

China & cables. The document's innovation part contains numerous references to the US and, in my view, far too few references to China. For the sake of objectivity, it should be noted that the European Commission is taking steps to reduce dependency on China, too.

Regulatory carve-outs for European businesses. Draghi openly acknowledged that Europe lost the competitive battle in digital technologies to the US more than 10 years ago. However, he also highlighted that in certain areas, there are potential niches for European businesses. Nothing wrong with targetting niche areas - but these ideas should be considered alongside the French tech associations' proposals for a "European tech first" approach in public procurement, as well as Ursula von der Leyen's political guidelines for 2025-2029, where the revision of the Public Procurement Directive and the intention to prioritize European businesses are clearly stated.

Uninteded consequences. There are no saints in international trade, so it is understandable that Europeans seek to secure better conditions for European businesses in the US. However, creating regulatory niches for European companies in sectors like digital can have unintended consequences, particularly for the already complex, lengthy, and often counterproductive public procurement processes related to digital transformation.

Comments on overregulation

The Brussels bubble was quick to celebrate Draghi's remarks that some digital regulations are overly strict and overly cautious, harming Europe’s own innovators.

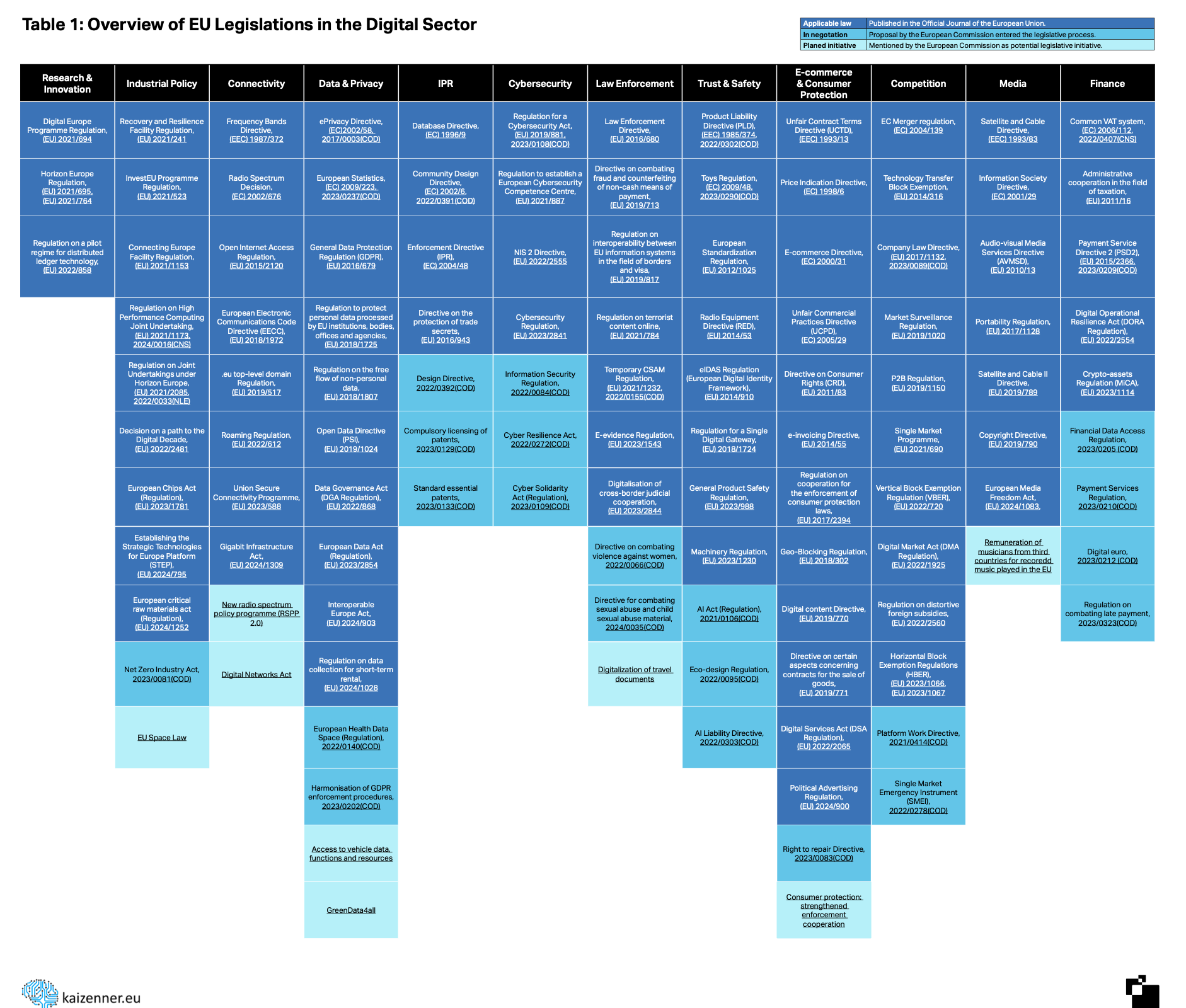

The remark is correct, yet a significant number of regulations were already adopted over the past 5 years (see Kai Zenner’s table of adopted and anticipated regulations below), often with annexes that don’t require political approval to be amended.

Moreover, despite relatively widespread requests for the new Commission to focus on implementation, rather than new regulation, a number of new initatives are already on the table for the next EU digital agenda (including bans on "infinite scroll," new procedures for e-advertising, network fees, extending European electronic communications code to cloud, and many more).

On EU Telecoms Act & consolidated EU telco market

One idea that I, as a Central Eastern European who enjoys relatively cheap and quality mobile services in my home country of Lithuania, personally find somewhat concerning is the proposal to consolidate the telecommunications industry.

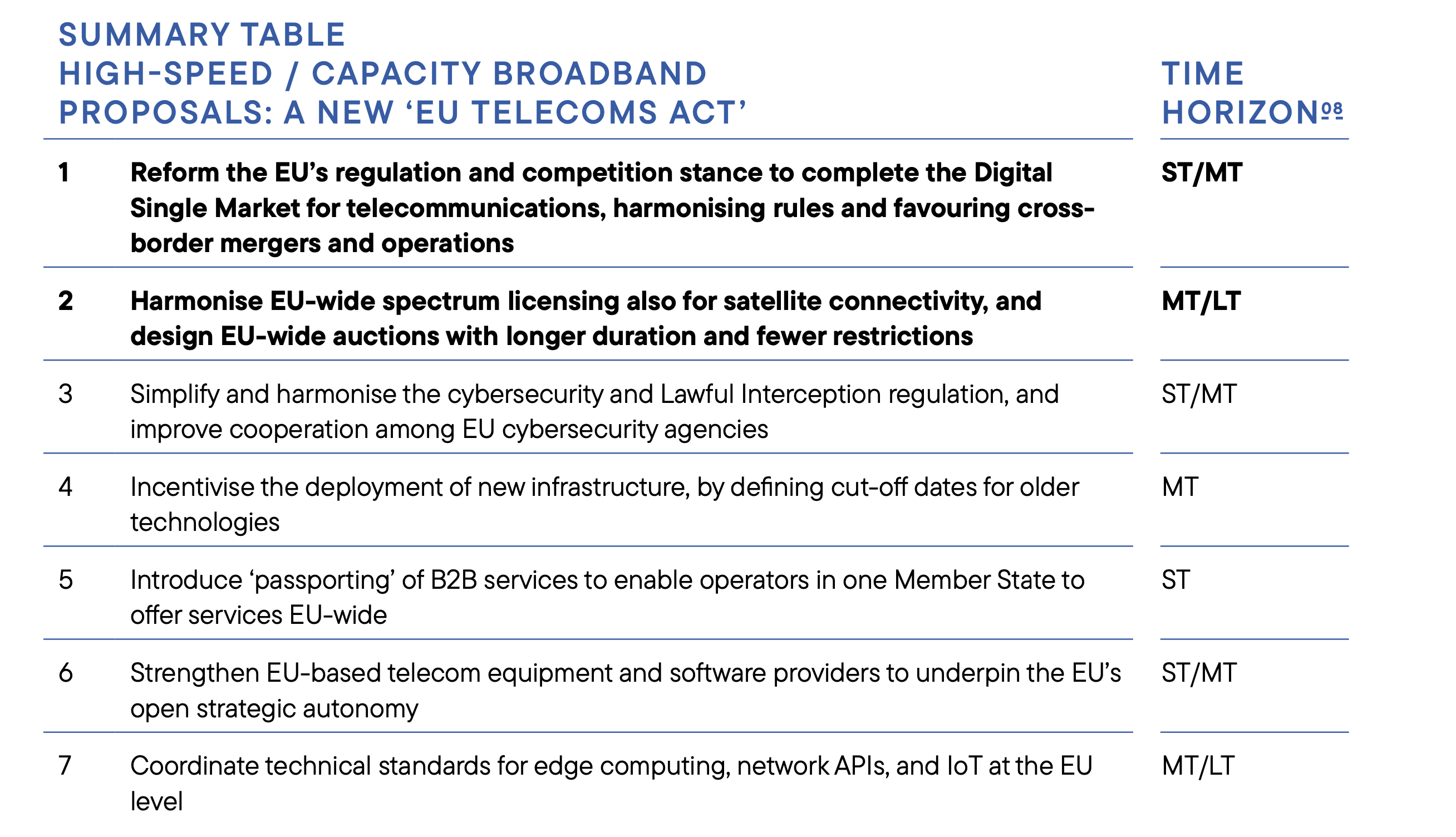

Fewer but bigger telco companies. This idea, also featured in Letta's report, envisions the creation of a Single Telecommunications Market. The ultimate goal is to replace all existing regulations, reduce the roles of national regulators, and enhance consolidated EU-wide regulatory functions. One of the outcomes have long been discussed is the goal to have fewer, but larger European telecom companies, which would be better positioned to compete globally.

Impact on consumers. The European telecommunications market is already quite competitive which results in good pricing and service quality for the European consumer, especially compared to markets like the US. It is, therefore, highly doubtful that smaller markets' representatives (who are likely to lose out on this) will easily say yes.

Vertical AI integration & and regulatory carve-outs for European cloud

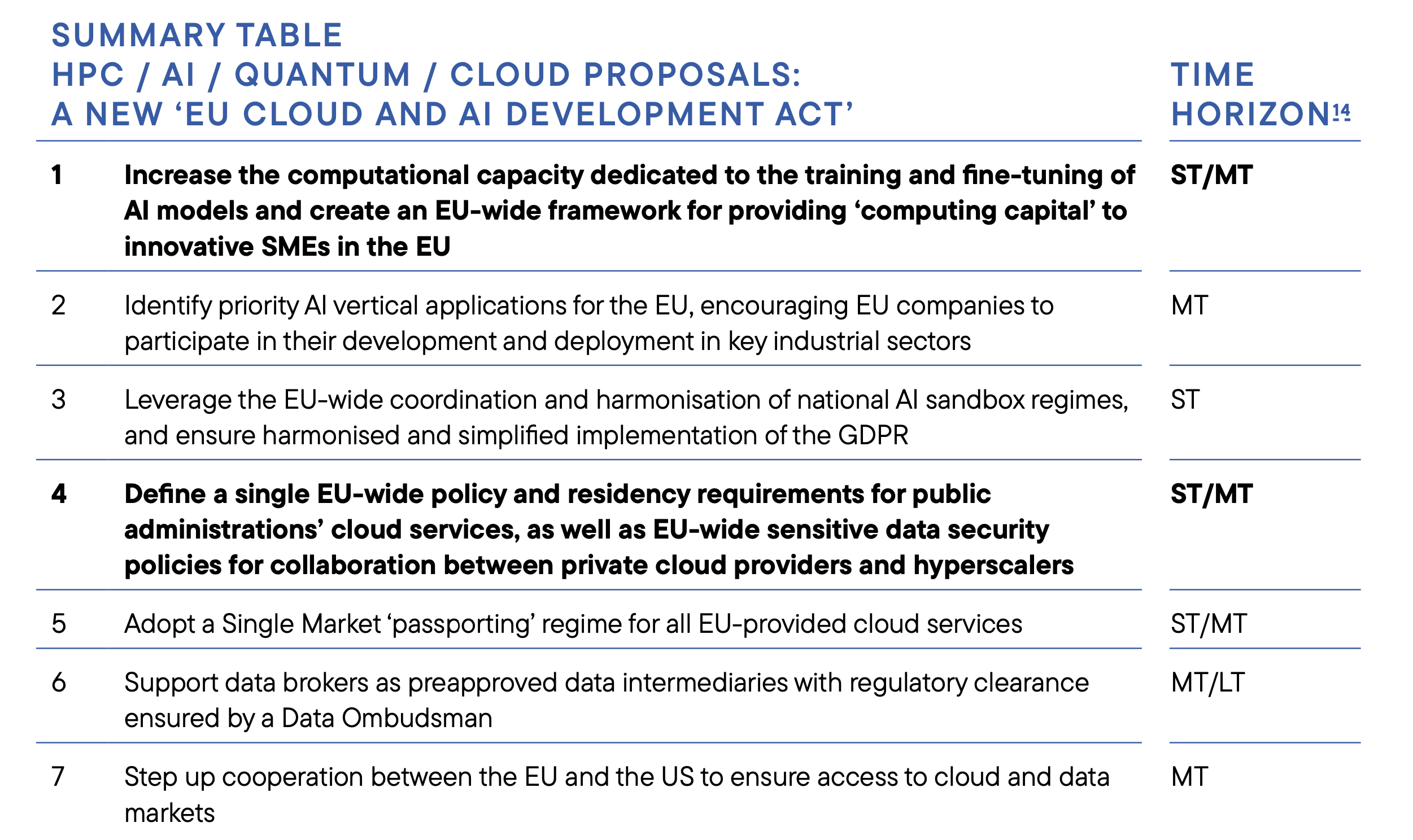

Vertical AI integration & European supercomputing capacity. Draghi sees a niche for AI in Europe through vertical integration of AI into the industrial sector which will require more cooperation between the industries, developers and researchers, he also wants to enhance European supercomputer capacity and extend it to innovative SME’s (see Summary table below).

Coordinated AI sandboxes. Coordinated operation of AI sandboxes on a European scale is also a good idea, but AI sandboxes in many European countries are just starting off and still need to develop before real progress can be made.

Cloud. Cloud-wise, Draghi admits Europe can no longer catch up with large international cloud service providers but also partially revisits the old idea of "sovereign cloud", residency requirements for public administrations' cloud services and more. We are yet to see cybersecurity specialists’ comments on the practical application of such solutions and assessing how much they would disrupt the existing system.

Commercialization of innovation and a bigger focus on academia’s shortcomings is needed

A billion (?) euro question on how to enhance the commercialization of innovation in Europe was also addressed.

Innovation clusters, fewer priorities and common projects. Draghi highlights the need to develop and strengthen European innovation clusters that bring together universities, finance, and innovative companies. He also advocates for fewer, more concentrated priorities and more investment in joint European-level projects in breakthrough areas - a good old idea that is difficult to implement with so many stakeholders involved. Draghi, however, proposes various institutional changes that could help make this task easier.

Money is not the only answer. Poor commercialization of innovations in the EU need not only additional incentives, but also a more sober, strict audit of results achieved by the European academic institutions which would aid in understanding why Europeans excel in fundamental research but fall short in other areas.

Make the EU unicorns stay in Europe!

Draghi mostly addresses two angles on how to help European innovators choose Europe over the US: access to finance and harmonized regulation to make the most of (an incoming) Single Market.

Access to finance. Draghi’s ideas on access to capital should be considered in the context of Enrico Letta’s proposals and the long-standing concepts of the Capital Markets Union, a European deep tech stock exchange, and enhancing the investment capacity of European insurers and pension funds to keep European savings in European markets rather than flowing to the US.

Access to data. The tax and regulatory environment must also be improved to keep European unicorns in the EU, with harmonization of regulations across the EU being the main instrument. Nevertheless, low access to data due to GDPR and related data regulations continues to be a major deterrent for data-focused tech companies from working with the EU market.

All roads lead to Silicon Valley. Last but not least, choosing the US over Europe can also be a matter of personal choice. Dynamic American VC ecosystem is attractive to most European companies, and an in-between-the-lines rule that one must be in Silicon Valley to make it big is surely hard to overcome.

To-do for small EU Member States

Experts in smaller EU Member States (such as the ones in Central Eastern Europe) have long advocated to actively prepare to operate as EU contributors, not beneficiaries.

While this prospect is still far away, possibly coming only after the further EU enlargement, Draghi's focus on pooling resources, joint innovation projects and investments shows that Europe is heading in a direction where businesses and research institutions will have to be even more competitive and ready for European-level cooperatation. At the moment most in Central Eastern Europe are not ready for this.

Further integration of the Single Market, regulatory changes aimed to circumvent Hungarian-type of veto blockages for various decisions, signal smaller EU Member States' public and private sectors to strengthen their capabilities and actively engage in EU-level decision-making processes.